Volume 21.10

Three methods are available to healthcare providers for determining lost revenues eligible to be applied as a qualified use of Provider Relief Funds. These are:

- Option 1: Actual 2020 and 2021 revenues compared against 2019 revenues,

- Option 2: Actual 2020 and 2021 revenues compared against 2020 budgeted revenues, or

- Option 3: Alternate lost revenue computation.

We have received numerous inquiries regarding the use of budgeted revenues in the determination of lost revenues. The following is provided by HRSA relating to the use of budgeted information:

“Lost revenues are calculated for each quarter during the period of availability, as a standalone calculation, with budgeted quarters serving as a baseline. For each calendar year of reporting, the applicable quarters where lost revenues are demonstrated are totaled to determine an annual lost revenues amount. The annual lost revenues for the years included in the period of availability are then added together. There is no offset.

Reporting Entities may use budgeted revenues if the budget(s) and associated documents covering the Period of Availability were established and approved prior to March 27, 2020.”

“When reporting use of Provider Relief Fund payments toward lost revenues attributable to coronavirus, Reporting Entities may use budgeted revenues if the budget(s) and associated documents covering calendar year 2020 were established and approved prior to March 27, 2020. To be considered an approved budget, the budget must have been ratified, certified, or adopted by the Reporting Entity’s financial executive, executive officer, or other responsible representative as of that date, and the Reporting Entity will be required to attest that the budget was established and approved prior to March 27, 2020. Documents related to the budget, including the approval, must be maintained in accordance with the Terms and Conditions.

https://www.hrsa.gov/sites/default/files/hrsa/provider-relief/prf-lost-revenues-guide.pdf specifically identifies the 2020 Budgeted Revenue as the basis for calculating budgeted revenues versus actual revenues for 2020 or 2021.

Many consultants are informing providers that they need a budget for 2021 for comparison to the actual revenues for the first two (2) quarters of 2021. Other consultants are recommending the use of budgeted revenues for 2020 to actual revenues for 2020; however, they recommend using actual revenues for the first two (2) quarters of 2020 to be compared against actual revenues for the first two (2) quarters of 2021.

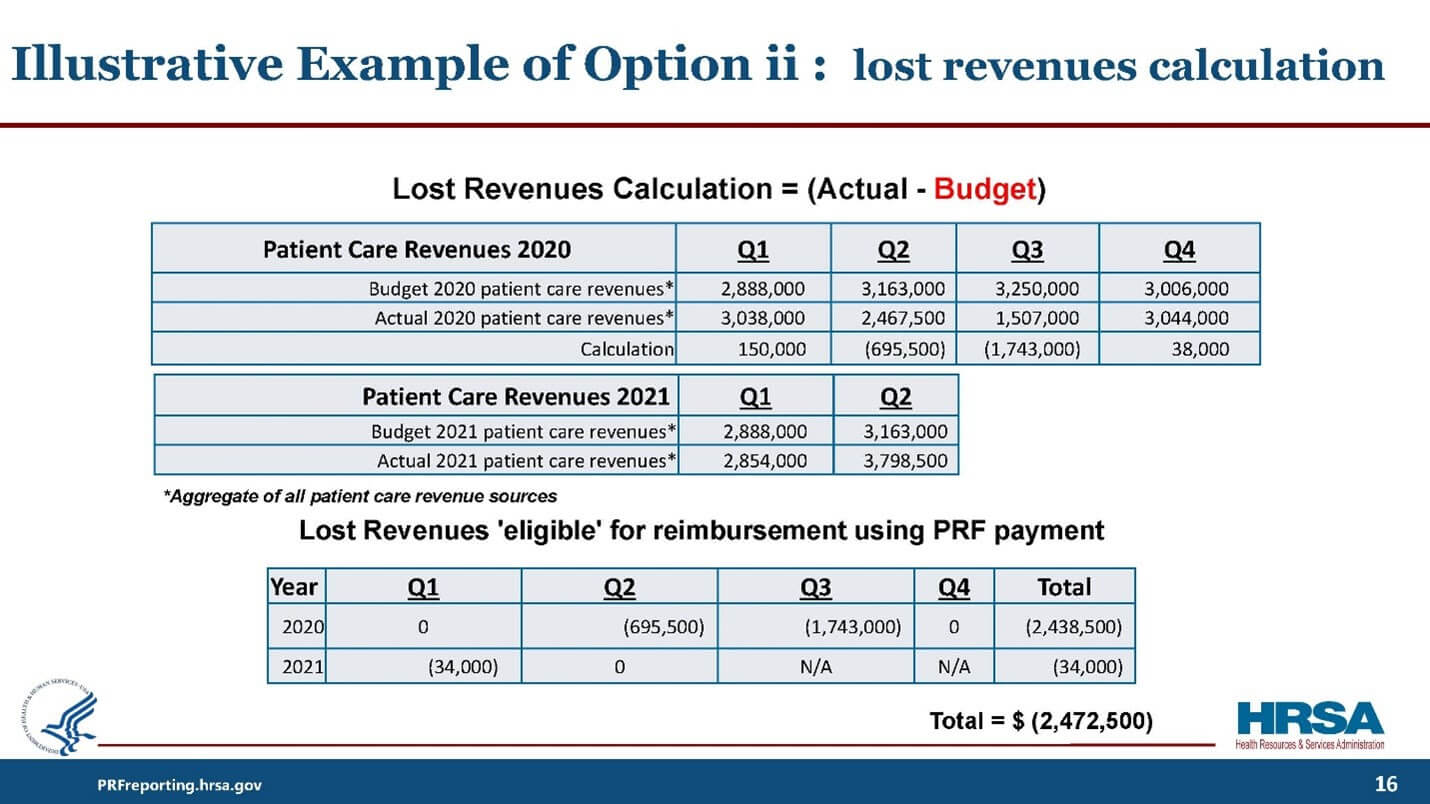

It is no wonder why many providers are confused. HRSA has presented the following information which clearly indicates that a qualifying 2020 budget is not only used for comparison to actual 2020 revenues, but also that the first two (2) quarters of the 2020 budget are used for comparison against actual revenues for the first two (2) quarters of 2021. As evidenced by the HRSA presentation, the first two (2) quarters of the 2020 budget are repeated for comparison against the 2021 actual revenues to determine lost revenues.

All providers are responsible for their submission and, accordingly, must select the process for identifying lost revenues; however, we believe the following as presented by HRSA is clear regarding the use of a qualifying 2020 budget (approved before March 27, 2020) solely as the basis against which actual revenues will be compared for both 2020 and the first two (2) quarters of 2021. This approach makes sense as the 2020 budget would have been developed and accepted (before March 27, 2020) without considering any COVID-19 PHE impact, thus providing an appropriate comparison to actual revenues generated.

The entire HRSA presentation regarding “Period of Availability and Lost Revenues” is available here. The information presented in the above slide has not been altered by any of the subsequent information released by HRSA.